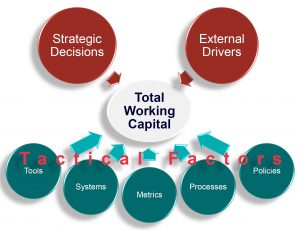

Working capital is influenced by a complex system consisting of external and internal factors as well as strategic decisions. External drivers are composed of economy, cost of capital, regulations and market position. Strategic decisions include geographies of customers and suppliers, customer mix and vertical integration. Tactical factors are policies, processes and metrics, systems and tools and also the degree of execution of the former.

Whilst external drivers and strategic considerations cannot be subject of short-term changes to gain cash advantage, tactical factors definitely are. Lean Six Sigma helps to analyse the drivers and their impact on the working capital situation. Working Capital meets Lean Six Sigma.

The Problem

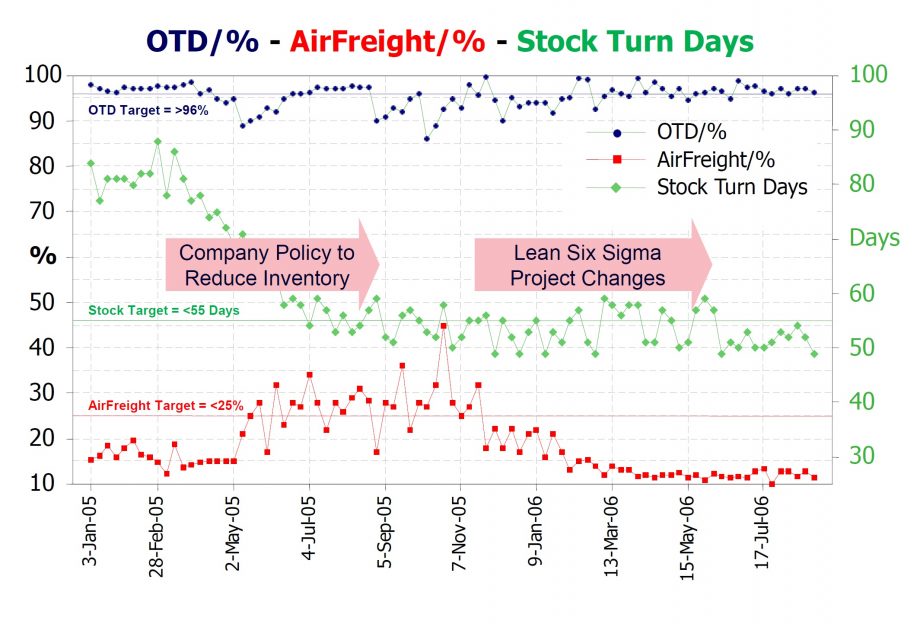

The South-East Asian logistics centre of a German multi-national supplier of electrical products for industrial use had decided to reduce inventory for common items from over 82 days stock turnaround time to 55 days – the world-wide standard for their company. Savings would have been significant if they could keep on time delivery (OTD) stable above the standard of 96%. Smart policy changes and new target settings drove the inventory down significantly. At the beginning all seemed to go well.

After implementing the changes and moving the focus away, something went unexpectedly wrong. In order to meet customer requirements, costs for freight exploded. Looking into the details revealed that the percentage of air freight from Europe to Asia had risen from around 18% to far beyond the 25% cap. I.e. the costs per kilogram freight went up resulting in additional costs of more than EUR 25k per month. First attempts to explain the situation by surging demand and wrong forecasts proved to be wide of the mark. A classic case of ‘running bottlenecks’ or in this case ‘running issues.’

Overcoming the Problem

In order to avoid more ‘damage’ by unqualified policy changes a Lean Six Sigma team was chartered to study the case and suggest solutions. A thorough analysis of the root causes supported by historical and newly collected data exposed the following major drivers for the triplet OTD, stock turnaround time and airfreight ratio:

- There was a mismatch between the reduction of inventory and the stock-reorder point set in the ERP system. Hence, a recalculation of the reorder point for a variety of products following the new policy was needed.

- The alarming ratio for triggering airfreight quantity and timing was not amended, too. It needed to be redefined along with all changes.

- Logistics staff did not “trust” in the inventory reduction decision. Therefore, they superseded ERP system suggestions based on their experience and intuition. This resulted in a “blind” ERP system not being fed with actual data and working with wrong assumptions.

Additionally, the study revealed other, less important drivers for high and unpredictable airfreight. They are demand fluctuation and forecast issues, long lead time for major products and sales staff promising unrealistic delivery dates.

Implementing a model for calculating reorder point and alarming ratio as well as involving and training Logistics staff solved the major problems. This was able to stabilise the airfreight ratio at around 12% – far below the company threshold. As a result, this saved a significant amount of money whilst keeping inventory low and customer satisfaction above target.

Long lead time of European suppliers triggered other working capital oriented Lean Six Sigma projects that fixed not only lead time but also quality issues.

Working Capital Meets Lean Six Sigma

Running Lean Six Sigma deployments for many years has taught us that weak or broken processes, ambiguous policies combined with misleading metrics as well as unaware staff not only lead to defective products and unsatisfied customers. They most certainly have a tremendous impact on profitability and cash flow, too.

Additionally, Companies are complex systems that need to be studied and understood well before making fundamental changes. Applying quick fixes on one end of the system can lead to failure at another end. Lean Six Sigma is designed to do exactly this.

On the one hand, combining your Lean Six Sigma deployment with a thorough analysis of your Working Capital Situation can lead to a more objective project selection and a greater effect of activities – Lean Six Sigma projects and others.

On the other hand, the Lean Six Sigma methodology helps to achieve reduction of Working Capital hidden in warehouses and processes through comprehensive and data-based root cause analysis, risk mitigation and implementation of improvements as well long-term process control.

Working Capital meets Lean Six Sigma.