- Home

- About Us

- Consulting

- Training

- Resources

Credit lines drying up are common phenomena these days. Past credit performance, even with a great history, seems to have no impact on the decisions of banks to lubricate the wheels of commerce. There is, however, a relatively cheap and available source of cash many firms have: Working Capital.

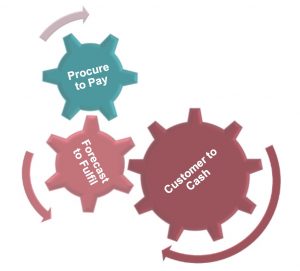

Working capital – or the cash flow of a firm – shows in three categories:

Working capital or “cash flow” resides on the balance sheet of a firm. Improvements in this firm-spanning area yield many returns including the reduced need for cash to keep operations running, a reduced requirement for finance facilities that attract interest payments (Weighted Average Cost of Capital or WACC), well tuned and simplified processes which often mean a reduction in operating expense and P&L impacts.

All these are some of the critical fundamentals that every analyst looks for in all economic climates. Even more so today.

Three Working Capital Areas Influencing Cash Conversion Efficiency

At the highest level, order to cash represents real demand as generated by customer orders. These orders trigger a series of processes culminating in invoicing and subsequently receivables. Aged receivables are one of the most common issues when it comes to calling in cash to keep the firm running. Frantic persistent calls can be made to customers to send payments. Or some pro-active measures may be taken.

Working Capital Area: Customer to Cash

Pro-active dispute management and resolution systems should be an integral part of receivables management. Payers often nitpick over issues found in invoices as a method to delay payments. The ability of a firm to catch potential disputes before they prevent payment from the customer is key. This is integral to best practice management of debt in most commercial scenarios.

In our experience, disputes are often a result of activities by the firm attempting to collect the receivables. An alleviation of these issues often removes most of the excuses for non-payment or slow payment. And it increases productivity in the receivables process since fewer errors occour to begin with.

Activities surrounding receivables management focus almost solely on the ‘back end’ of these processes and involve some degree of pleading to legal action and through the sale and amortisation of debt, often for a large discount. Pro-activity in some areas and the optimisation of others, while not leading entirely to zero late receivables, goes a long way in reducing cash that is unnecessarily tied up in the order to cash system. Typical improvements in this area range from 5% to 30% reduction in receivables over the long term.

Upon receipt of a customer order, in most cases or a demand forecast in others, the inventory management series of processes kick in. Ordering raw materials helps preparing for meeting demand. Cash is tied up the minute inventory arrives at the door – in some cases even before it arrives at the door since LCs (Letters of Credit) require, essentially, upfront payments to be made especially when credit is difficult to obtain.

Working Capital Area: Forecast to Fulfill

WIP inventory meanders through the firm in various forms often constituting a large part of inventory holdings in volume. Prevailing paradigms fight to keep inventory in the WIP status as long as possible to contain cost. This way the various value added activities did not yet cost cash.

Lean processes in the manufacturing or assembly phases along with a paradigm shift toward the concept of inventory (from an asset to a liability) are what drive some of the most profitable manufacturers in the world. Positioning for channel power and managing customer expectations in collaboration with industry participants goes a long way in containing inventory as one of the larger predators of cash in a production oriented firm. Optimal inventory management not only benefits the cash flow positioning of a firm, it reduces the risk of obsolescence and reduces the cost of sales rather dramatically – a great way to link balance sheet improvements to more agreeable P&L statements.

Impressive results through forced and dramatic reductions in inventory are the rage these days. Many firms become cognizant of the fact that much cash is inactive in this area. While easy to execute, simply by decree, there lies issues with the production or operations systems that converts raw material into finished products. However, these systems are not designed for starvation. Hence, the shocks from simply starving the system this way lead to massive losses of confidence by employees and results in necessary layoffs. An opportunity for paradigm change, supported by appropriate methodologies governing inventory from the operational through the strategic level, is at hand. For manufacturing facilities, the investment in improving inventory or supply chain related processes often yields up to 70% less inventory. Opex reductions follow suit though not so massive relative to inventory.

Coinciding with the commencement of inventory management is the area of procurement. Strategic procurement through to simple purchasing comprises of myriad activities. Ending this process are payment activities which are often a resource for cash release except for tools which typically engender destructive competition.

Working Capital Area: Procure To Pay

Opportunities abound in the P2P process as much as they do in C2C and F2F arenas. Rationalising supplier bases is an undertaking that is getting harder and harder these days with conglomerates rising like never before through furious M&A activities. Once rationalised though, appropriate methods and policies should be in place to classify spend for further action. This will result in better prices, terms, conditions or all three in the best case. An ability to understand and control spend well should yield both working capital reductions as well as process simplification and hence operational expenditure.

Channel power is a way to quickly and easily realise benefits in the P2P domain. Manifestations include simply locking up the cheque book or delaying payment till the legal notice arrives are endemic. These solutions do not work long-term, as General Motors once found out. Lack of cooperation from suppliers may be circumvented, again through channel power. But the unwillingness of suppliers to innovate (as a method of cost reduction or efficiency / product improvement) and share these innovations with purchasers who drive extremely tough bargains while lagging on payments will put an effort to nil.

Even retail giant, Wal-Mart, tries its best to ensure that suppliers do not get treated unfavourably. Work in this area of working capital management pays off bottom line results while potentially also raising top line figures. Transaction costs may be reduced up to 40% while purchasing costs may drop by some 3% to 20%.

Strategically the improvement of working capital results in increasing EVA for the firm. Freeing up cash, in rather difficult times provides a cheap source of funding. No firm is beholden where finance costs are concerned. Viewed favourably by analyst of all stripes, the methodological improvement in processes, policies and KPIs surround total working capital (TWC). It also yields a lean enterprise that is flexible and agile while lowering overall operating expense.

Most working capital issues are due to process problems. Be it purchasing process, invoicing process or just manufacturing, assembly or delivery process, all these processes eat less into the balance sheet if they are lean and error-free.

A perfect lean process follows one piece flow. I.e. an order starts the process of making the product. And it is exactly meeting customer specifications. Only after receiving this order, purchasing and assembly start. This ideal lean process may not be workable all the time but it pays off to work towards that.